Cash sales: sales on the accrual basis are $242,000.Depreciation of $5,000 and pre-paid expense both relate to selling and administrative expenses.Receivables relate to sales and accounts payable relates to cost of goods sold.The net cash flows from operations are determined by the difference between cash receipts and cash disbursements.Īssume that Bismark Company has the following balance sheet and income statement information: This method converts each item on the income statement to its cash equivalent. Under the direct method, the statement of cash flows reports net cash flows from operations as major classes of operating cash receipts and cash disbursements. The reporting of investing and financing activities is the same for both direct and indirect methods.

Partly because companies want to limit information disclosed, the indirect method is more commonly used. However, the direct method discloses more information about a company. GAAP, both the direct and indirect methods are acceptable for financial reporting purposes. Both methods produce the same net figure ( dollar amount of operating cash flow).

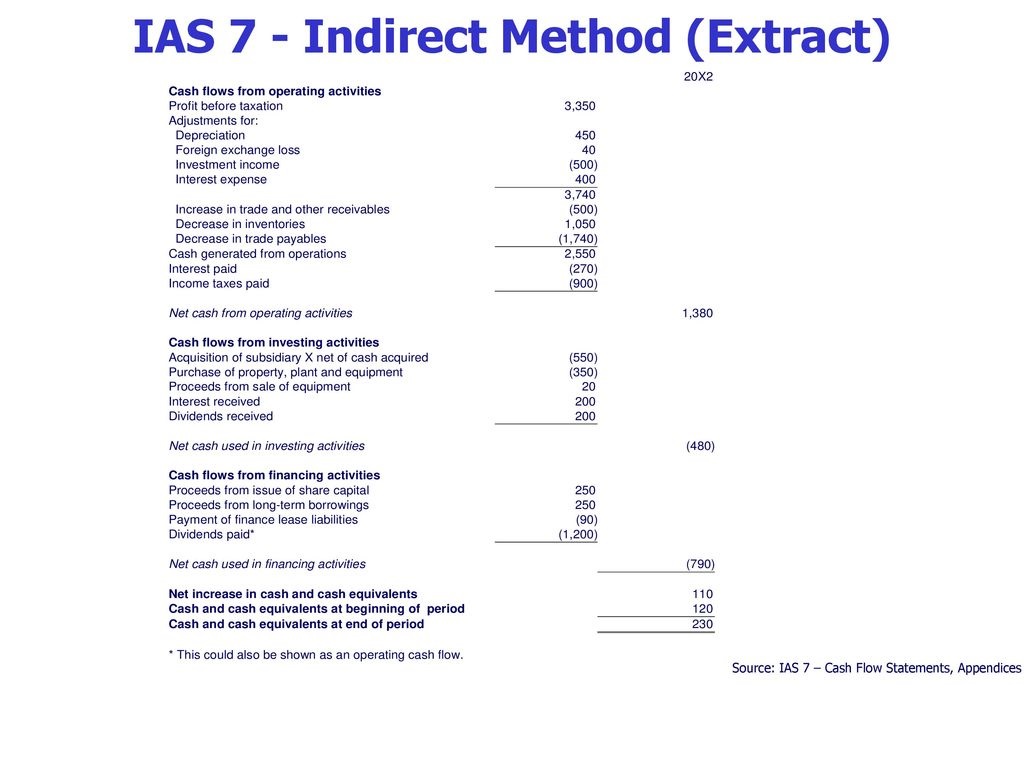

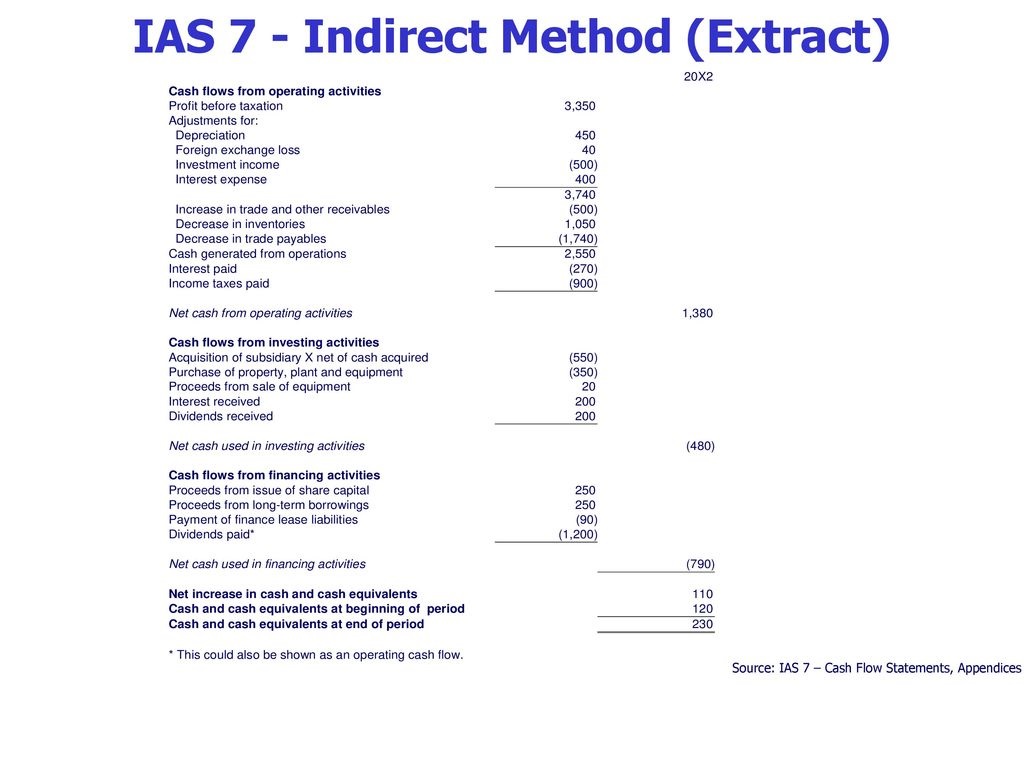

The direct and indirect methods are alternative formats for reporting net cash flows from operating activities. It shows why net income and operating cash flows differ. The indirect method reconciles net income to net cash flow from operating activities by adjusting net income for all non-cash items and the net changes in the operating working capital accounts. More cash flow information can be obtained and it is more easily understood by the average reader. It shows operating cash receipts and payments. It adjusts each item in the income statement to its cash equivalent. The direct method discloses operating cash inflows by source (e.g., cash received from customers, cash received from investment income) and operating cash outflows by use (e.g., cash paid to suppliers, cash paid for interest) in the operating activities section of the cash flow statement. Companies can use either the direct or the indirect method for reporting their operating cash flow. There are two methods of converting the income statement from an accrual basis to a cash basis. Finally, non-operating gains and losses enter into the determination of net income, but the related cash flows are classified as investing or financing activities, not operating activities.

Another reason is the many timing differences existing between the recognition of revenue and expense and the occurrence of the underlying cash flows.

These expenses, which require no cash outlays, reduce net income but do not affect net cash flows.

One reason is non-cash expenses, such as depreciation and the amortization of intangible assets. Net income differs from net operating cash flows for several reasons. The beginning and ending cash balances on the statement of cash flows tie directly to the Cash and Cash Equivalents accounts listed on the balance sheets at the beginning and end of the accounting period.

0 kommentar(er)

0 kommentar(er)